Are GICs a Good Investment for Women?

One of the most common questions I get from women is this: “What’s a safe investment to put my money in? I don’t want to gamble with it.”

I understand the desire for safety.

You work hard for your money, and while you know that you need to grow a nest egg for retirement, the last thing you want to do is put your money in a risky investment where you could lose it all.

Which is why Guaranteed Investment Certificates - or GICs for short - are so attractive to women. The money you invest is guaranteed and so is the interest rate for the term you select.

For example, if you invest $10,000 in a 2-year GIC that provides 2.5% interest, you know that at the end of those two years, you’re getting your $10,000 back plus the 2.5% interest per year (assuming you’ve invested it through a financial institution that is backed by deposit insurance).

What’s not to love about that? Safe, right?

Not exactly. It depends on what you mean by safe.

Today I want to cover two questions:

Are GICs a wise investment for women?

And what does “safe” mean when it comes to investing?

Let’s take a look.

(By the way, for my readers outside of Canada, you probably have a comparable product where the principal and interest rate are guaranteed. The points I make about GICs will likely apply to your guaranteed investments, too.)

The Downsides of Safety

Until recently, I had not invested in a GIC since I was 18 years old – which was, shall we say, a while ago. 😁

Why?

Because GICs typically offer low rates of return. A quick look at the current offerings shows that you’ll get roughly 2.7% to 3.7% per year, plus you’ll need to lock up your funds for two to three years.

It’s true that you can find cashable GICs, where your funds are accessible throughout the term, but their interest rates are even lower than standard GICs.

The bottom line is that you are not going to make a whole lot of money with these products.

So why would anyone choose these products if the rates are so low?

Up until recently, I would have said that they’re not a great product for women for a couple of key reasons.

First, any investment that does not yield returns above the rate of inflation, after tax, will hurt you in the long run.

In Canada, the current rate of inflation is somewhere in the 2.6% range. That rate has fluctuated significantly over the last ten years, particularly during the pandemic.

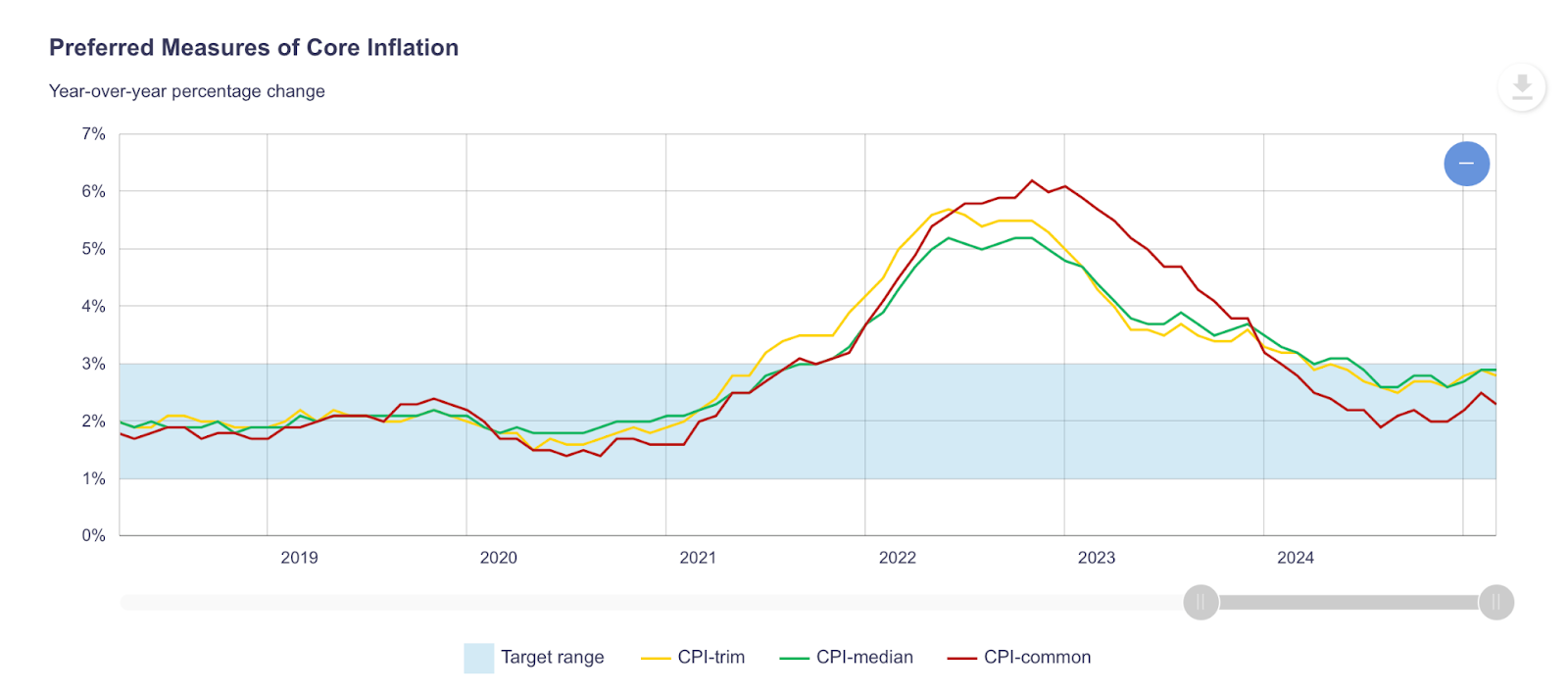

Here’s a graph from the Bank of Canada:

The BOC is targeting a rate of inflation in the 1% to 3% range, but during the latter years of the pandemic, that rate increased far beyond 3%.

Consider this:

Let’s say you have $1,000 to invest and since you don’t want to risk losing the principal, you decide to put it into a guaranteed investment for a couple of years at a rate of 2.7%.

The problem with this approach is that inflation is shrinking the value of your money faster than your investment is growing it.

The best case scenario is that you put your money in a tax-sheltered account - i.e. a TFSA or an RRSP - and there’s no loss to tax. In so, your money hasn’t grown at all once you factor in the cost of inflation.

If your money is in an unregistered account, then it’s subject to tax and now your purchasing power has shrunk. You still have your $1,000 available to you plus a bit of interest, but your money now buys you less than it did for the same amount just a couple of years ago.

There’s a great analogy on the Inflation Data website:

“Over the long run since 1913, inflation has averaged more than 3% (3.24% ), so on average it has taken less than 22 years for prices to double.

As you are saving, it is like trying to fill a bucket while 3% is leaking out, which means you have to put it in faster than it leaks out.”

There’s the rub:

If you’re choosing a guaranteed investment that yields below-inflation returns, your financial bucket is leaking purchasing power.

What this means for women

This is a big deal for everyone, but especially for women.

Why? Because on average we earn less than men. We’re also growing our wealth much more slowly.

In her book, Why Women Have Less Wealth and What Can Be Done About It, Mariko Lin Chang shared the following findings:

🔸 Women make 78% of what men make. (For those under 25, the ratio is 95%, so the youngest generation is closing the gap.)

🔸 Despite this, women only own 36% as much wealth as men. Therefore, there is a huge wealth gap.

🔸 Women and men have a different perception of risk.

🔸 Women are more likely to view lost money as irreplaceable.

🔸 Men have a greater sense of confidence about their ability to make money.

🔸 Women still shy away from getting involved in investments.

A few years ago, I had the pleasure of interviewing Alan MacDonald, a wealth management adviser with Richardson GMP, for an article on investing and financial advisors.

He shared many interesting points. In his experience, women are typically more conservative than men and they tend to defer to their male partners despite the fact that when they actually get down to the business of evaluating investments, women typically do a great job.

The bottom line? We’re leery of investing, so we shy away from it altogether. When we do get involved, we pick lower-risk options - like GICs.

For a variety of reasons, not the least of which is the wealth gap as defined by Chang, I encourage every woman to aim for higher than bottom-of-the-barrel returns.

And we should definitely seek to accomplish more than just replacing the amount eroded by inflation.

You can’t save your way to wealth

Alan pointed out that no one saves their way to wealth. You can save your way out of being poor, but to develop wealth you need to do a lot more than that.

Most GICs, therefore, are not the best idea for the bulk of your money.

Having said that, I just parked a chunk of change in a 2-year GIC.

In my regular review of the personal finance landscape, I saw a rate of 3.95% at Oaken Financial for a 2-year GIC.

Here were my thoughts:

• That beats the returns that my bonds have been yielding over the past 5 years.

• It exceeds the rate of inflation by enough that my money will keep pace with inflation and grow.

• It’s a great option for short-term cash.

• It’s also a good option, for now, for extra cash destined for my fixed income investments because the 3.95% rate beats anything I’m seeing in the bond markets.

• I can re-evaluate in two years when the funds mature.

It was a great, short-term option for my money and I took it.

The bottom line

GICs are one of many investing tools at your disposal. When they’re used well - for short term investments when their rate exceeds the rate of inflation or when their rate allows you to make some money rather than letting your money stagnate in a regular savings account - they can be effective.

Just be careful with them. They’re an optimization tool, not a great long-term investment tool for the bulk of your money.

Don't be seduced by the illusion of safety. Yes, they won’t put your principal at risk, but they might just put your future at risk by eroding the value of your money.

Safety is a relative concept here.

There are plenty of investment options that do not involve high levels of risk while yielding far more over the long term than guaranteed products ever will.

If you don’t know where to start, enroll in my Investing Made Simple program and I’ll teach you an evidence-based way to build wealth and become a confident investor.

Don’t let fear chain you to low returns for the long haul. That will guarantee that you never achieve financial freedom. We don’t want that!

All it takes is skills, a good system, and support. I can help you with that.

Want to chat about the best way to improve or strengthen your finances?

Set up a free Discovery Call. We'll go over your current situation, the challenges you face, and some options to get you on the path to achieving your financial goals.